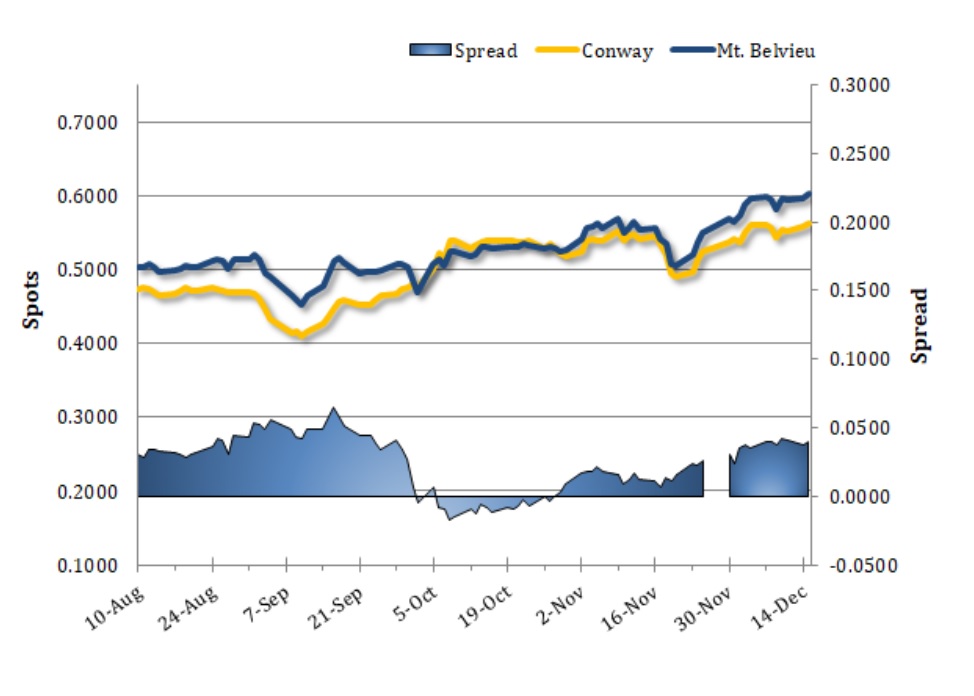

Benchmark propane prices strengthened along with crude futures yesterday. Brent gained 0.9% and WTI climbed 1.3% higher with strength in equities and weakness in the US dollar, despite bearish demand forecast revision by the IEA. Mt. Belvieu TET propane climbed 1.1% (63 points) higher to 60.25c/g, and Conway spots gained 0.8% (44 points) to reach 56.31c/g. Meanwhile, NYMEX natural gas futures settled unchanged.

PROPANE SPOTS & SPREAD (CONWAY | MT. BLEVIEU)

Crude futures were seeing small losses ahead of the weekly EIA inventory report, following bearish crude oil and distillate stock data from the API industry group, despite mostly higher trade in US and European shares following encouraging European data, but disappointing US figures, and also despite fresh multi-year lows in the US dollar index. WTI futures were off 0.4% and Brent crude futures had slipped 0.4% lower as well as of this writing. Propane prices were rallying ahead of release of the weekly inventory report. Mt. Belvieu TET prices were up 3.5% (2.13 cents) at 62.38c/g, non-TET was at 62.19c/g, and Conway spots had climbed 2.6% (1.44 cents) higher to 57.75c/g.

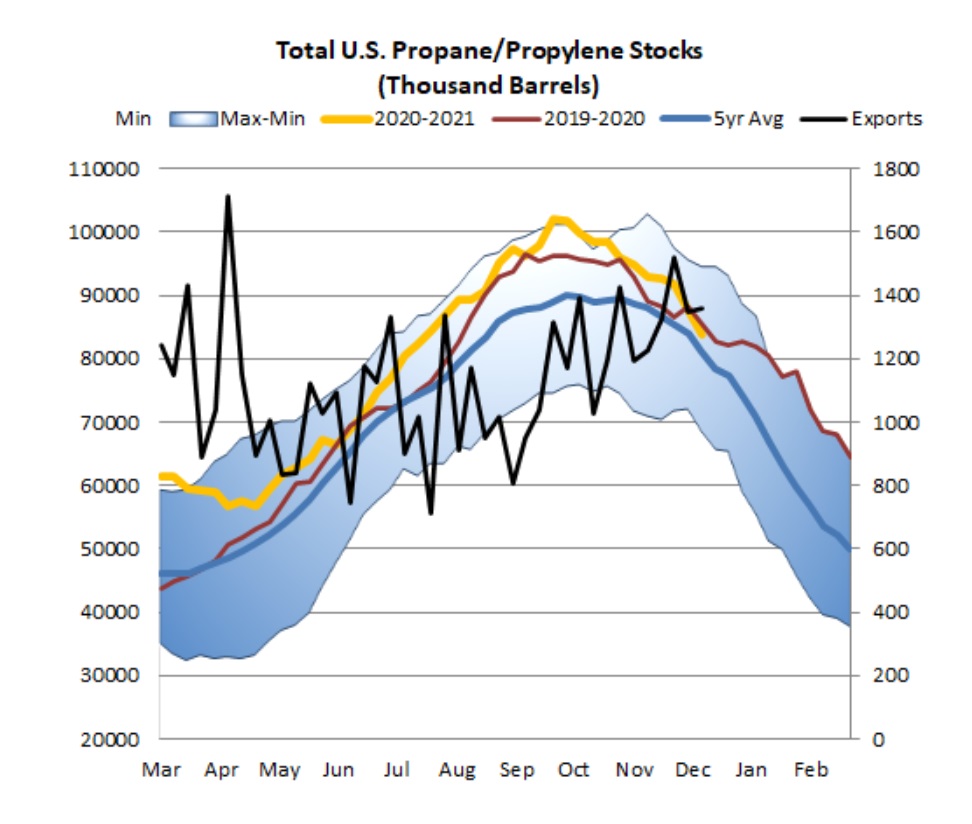

PROPANE STOCKS

The weekly EIA report released this morning was bullish for propane. The agency reported a 3.71mb draw from combined propane and propylene stockpiles for the week ended December 11, exceeding the 2.10mb draw predicted by analysts (average of surveys conducted by OPIS and Clarksons). The larger than expected draw came as implied demand and exports outpaced production and imports. Implied demand slipped 1.2% lower but remained strong at 1.67mb/d, about flat to last year. Exports rose marginally to 1.36mb/d, which is well above last year's 1.23mb/d during the same week. Meanwhile, production rose marginally to 2.32mb/d but is down from 2.41mb/d last year. Imports rose slightly to 0.18mb/d, which is an increase from 0.14mb/d last year. Gulf Coast stock levels dropped 2.32mb lower to 45.84mb, which is now 3.6% below the weekly five-year average, and Midwestern inventories dropped 1.68mb lower to 24.09mb. However, Midwestern stocks are 2.3% stronger than their five-year average for the week. East Coast stocks saw a counter-seasonal build of 0.36mb, rising to 8.32mb and a 29.2% surplus over their five-year average. Overall, US stocks remain in solid shape, and today's data were unsupportive for East Coast differentials to Mt. Belvieu, and supportive of a wider discount for Conway prices relative to Mt. Belvieu.