The information provided in this market update is general market commentary provided solely for educational and informational purposes. The information was obtained from sources believed to be reliable, but we do not guarantee its accuracy. No statement within the update should be construed as a recommendation, solicitation or offer to buy or sell any futures or options on futures or to otherwise provide investment advice. Any use of the information provided in this update is at your own risk.

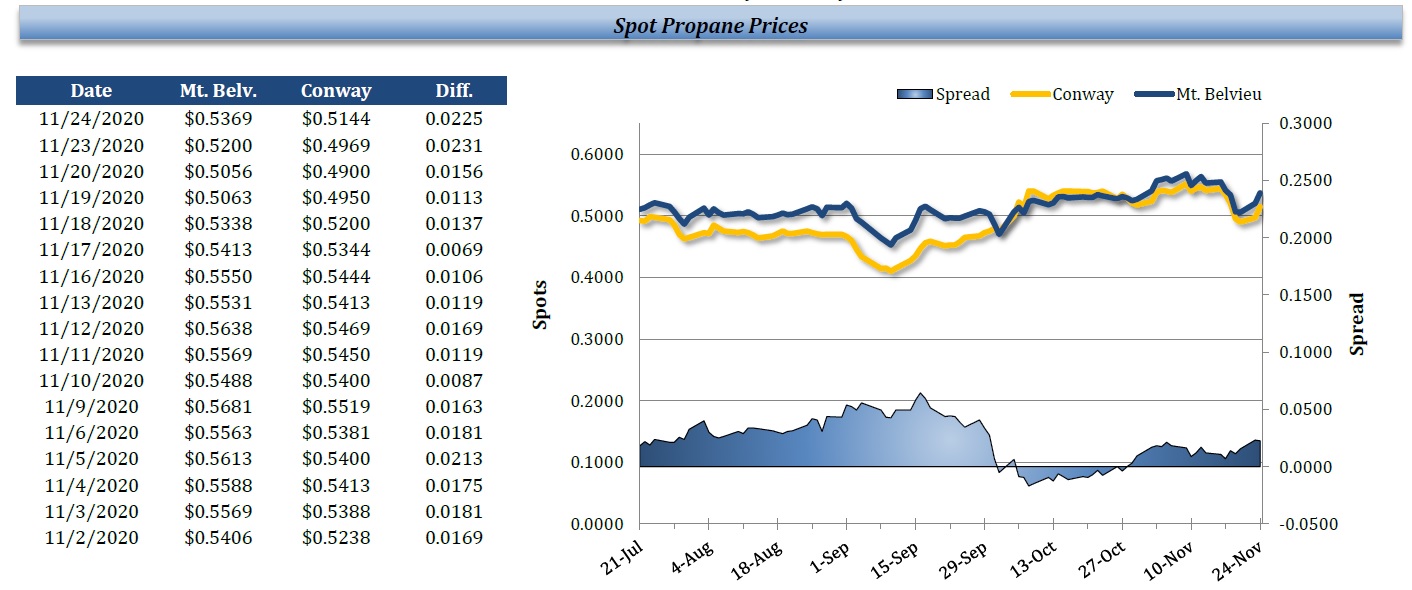

Propane prices strengthened for a second session on Tuesday, rallying along with crude futures. Mt. Belvieu TET prices jumped 3.3% (1.69 cents) higher to 53.69c/g and Conway prices strengthened 3.5% (1.75 cents), hitting 51.44c/g. Brent crude futures climbed 3.9% higher, while WTI shot up 4.3% amid strength in equities following news that the Biden transition team was being granted access, as well as geopolitical tensions with Saudi Arabia confirming that a missile launched by Houthi forces in Yemen struck a distribution plant in Jeddah. Natural gas futures also strengthened yesterday, by 2.4% with a stronger two-week heating degree day forecast from the GFS.

Crude futures continued higher this morning amid generally favorable US economic data releases and weakness in the US dollar index, as well as news of a tanker being hit by a mine at a Saudi Arabian terminal, even as European and US shares mostly weakened. Propane prices were also rising ahead of the weekly EIA inventory report, with Mt. Belvieu TET prices up 1.8% (94 points) at 54.63c/g (non-TET at parity) and Conway spots up 1.8% (94 points) as well, at 52.38c/g - keeping the spread steady at 2.25 cents.

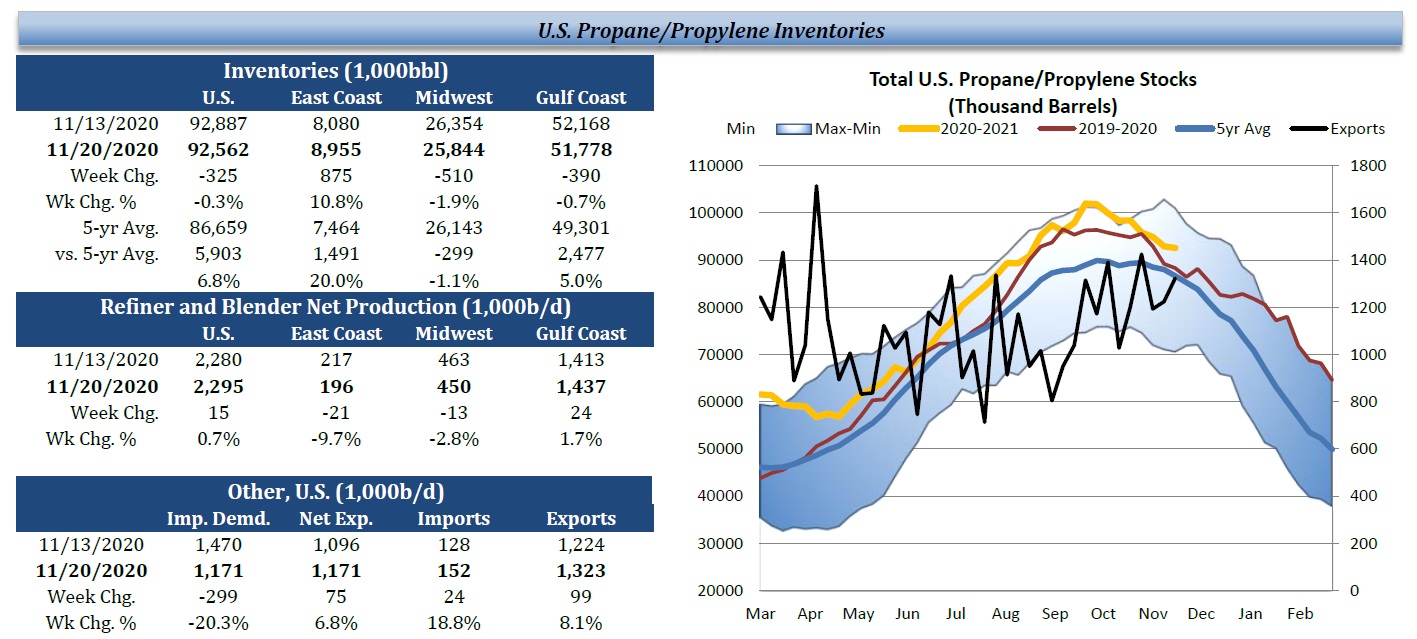

The EIA stock report for the week ended November 20 was unsupportive for propane, as the agency reported a 0.33mb dip in combined propane and propylene stockpiles, whereas analysts surveyed by both Clarksons and OPIS saw a larger stock draw of 1.6mb. Implied demand dropped 299kb/d to average 1.17mb/d last week, helping to limit the size of the draw, as did a 24kb/d uptick to 152kb/d in imports and a marginal increase to just under 2.30mb/d in production. Exports, however, picked up by 8.1% to average 1.32mb/d this latest reporting week. Gulf Coast stocks fell by 0.39mb to 51.78mb but are still 5.0% higher than their five-year average. Midwestern inventories shed 0.51mb and are now 1.1% below their five-year average, sitting at 25.84mb. East Coast stocks saw a counter-seasonal build of 0.88mb, reaching 8.96mb and a surplus of 20% over the five-year average. Stock data continue to support a narrow north-south spread, while staying in decent shape in aggregate with a 6.8% surplus over the national five-year average.

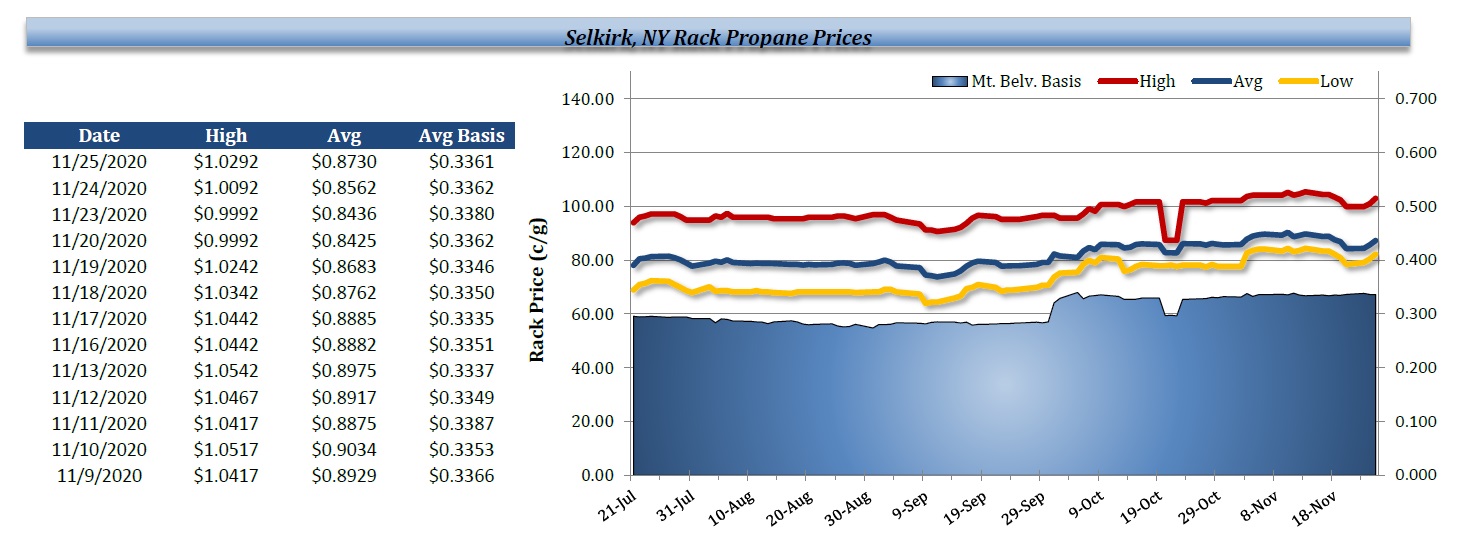

Selkirk NY Rack Propane Prices