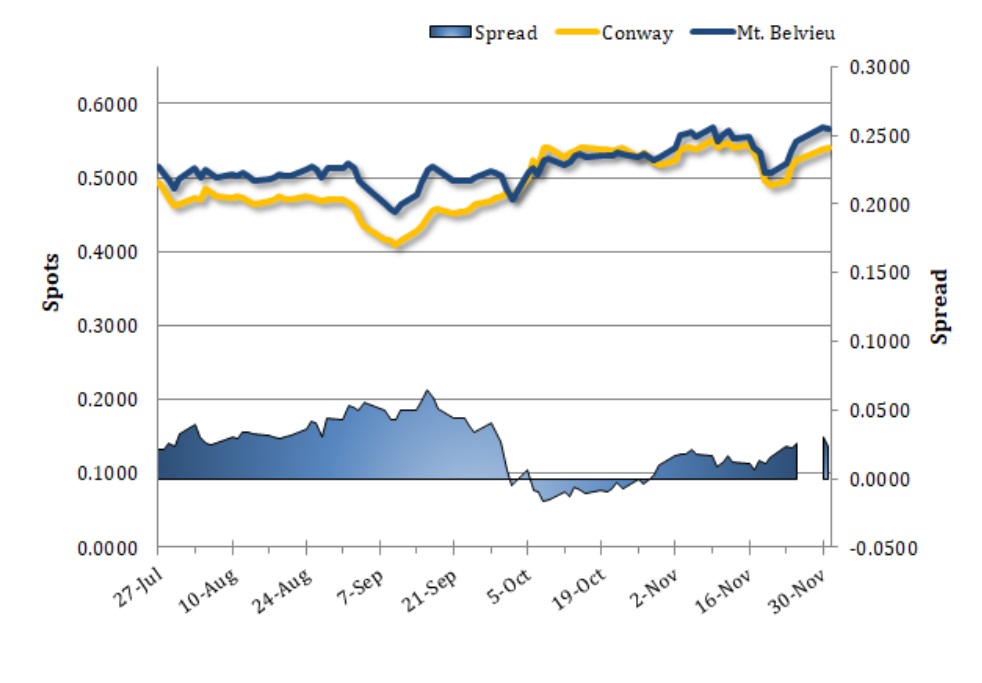

Propane prices made mixed moves on Tuesday, as Mt. Belvieu TET prices fell along with crude futures while Conway prices strengthened. Brent crude fell 1.0% and WTI crude lost 1.7% yesterday following news that OPEC+ talks were being pushed back until Thursday due to disagreement on policy, despite strength in equities and weakness in the US dollar. Mt. Belvieu TET propane prices fell 0.6% or 31 points to 56.50c/g, but Conway spot prices climbed 0.7% (38 points) higher to 54.13c/g, cutting the spread between the two benchmarks down to 2.37 cents.

Crude futures were up slightly near release of the weekly EIA inventory report, with WTI up 1.0% and Brent having gained 0.5% despite mostly weaker trade in equities and a slight appreciation in the US dollar index. Propane prices were again seeing mixed moves, as Mt. Belvieu TET prices were up 0.4% (25 points) at 56.75c/g (non-TET even higher at 57.38c/g), while Conway spots were falling - down 1.6% or 88 points at 53.25c/g.

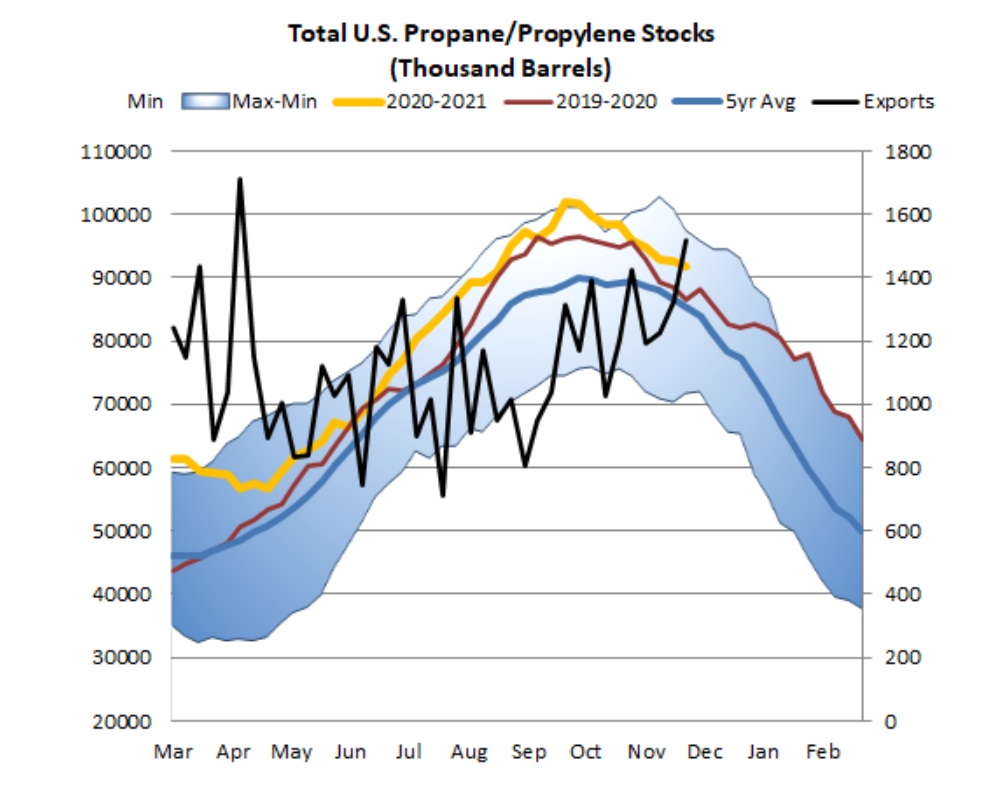

The weekly inventory report released by the EIA this morning was unsupportive for propane (and actually unsupportive all around). The agency reported a 0.84mb dip in combined propane and propylene stockpiles, below expectations at 1.42mb (Clarksons survey). The smaller than expected stock decline was helped by a 13.7% (161kb/d) drop in implied demand, which averaged 1.01mb/d last week - well below the 1.77mb/d seen during the same week last year. On the other hand, exports picked up by 15%, averaging 1.52mb/d and well above last year's 0.84mb/d during the same period. Production and imports fell marginally, averaging 2.29mb/d and 0.12mb/d, respectively. Gulf Coast stocks fell by 0.56mb to 51.22mb, but are still 5.1% higher than their five-year average. The Midwest saw only a 0.01mb draw, leaving stock levels at 25.75mb and with a 0.8% surplus over their five-year average. East Coast stock levels fell by 0.28mb to 8.68mb and are still 20.8% above their historical average. Inventories overall remain in good shape at this point in the heating season.